Can You Use Independent Contractors?

The following is the story of how one person came to an understanding of what an “Independent Contractor” is.

The following is the story of how one person came to an understanding of what an “Independent Contractor” is.

The morning sun was just warming the tops of the hills surrounding the lake as Ed dropped his line in the water and made himself comfortable in the deck chair. The light breeze was just enough to cause small waves to lap against the pontoons of the houseboat and give a rocking motion to the craft. Ed knew none of the others would be getting up any time soon.

A Story to Grow From: The Business Killed by a $27,000 Penalty

Ryan was deep in thought about what he was going to do now that his business was killed by the IRS penalty. Why had he not paid attention to his tax adviser when he told him about the tax law change about the medical reimbursement plan?

Ryan was deep in thought about what he was going to do now that his business was killed by the IRS penalty. Why had he not paid attention to his tax adviser when he told him about the tax law change about the medical reimbursement plan?

Ten Essential Business Functional Areas

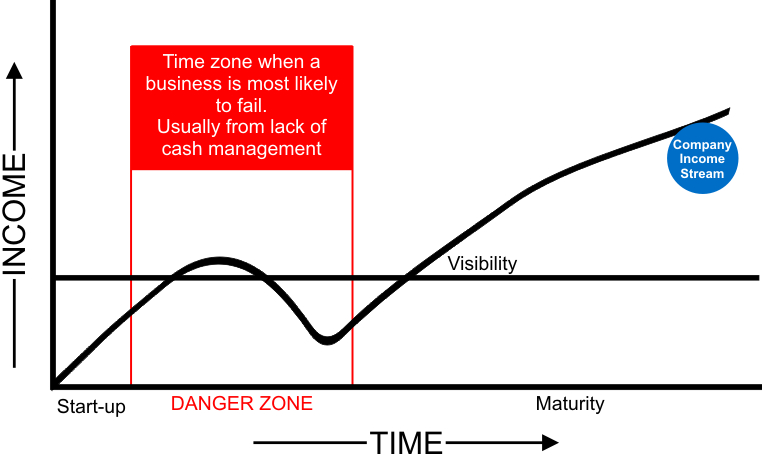

When designing a business it is critical that all aspects of the business be addressed. It will not work to concentrate on sales or production or any other part of the business and ignore other parts. So, what are all these other parts that you should address?

When designing a business it is critical that all aspects of the business be addressed. It will not work to concentrate on sales or production or any other part of the business and ignore other parts. So, what are all these other parts that you should address?

Business Help Resources

- Can You Use Independent Contractors?

- Doing Business in the 21st Century Electronic World

- How to Get Up and Running

- Notice to LLC Owners

- Ten Essential Business Functional Areas

- The Money Pump

- Understanding Risk Management

- What You Need to Know Before Starting a Business

- What You Need to Know When Your Business Needs Workers